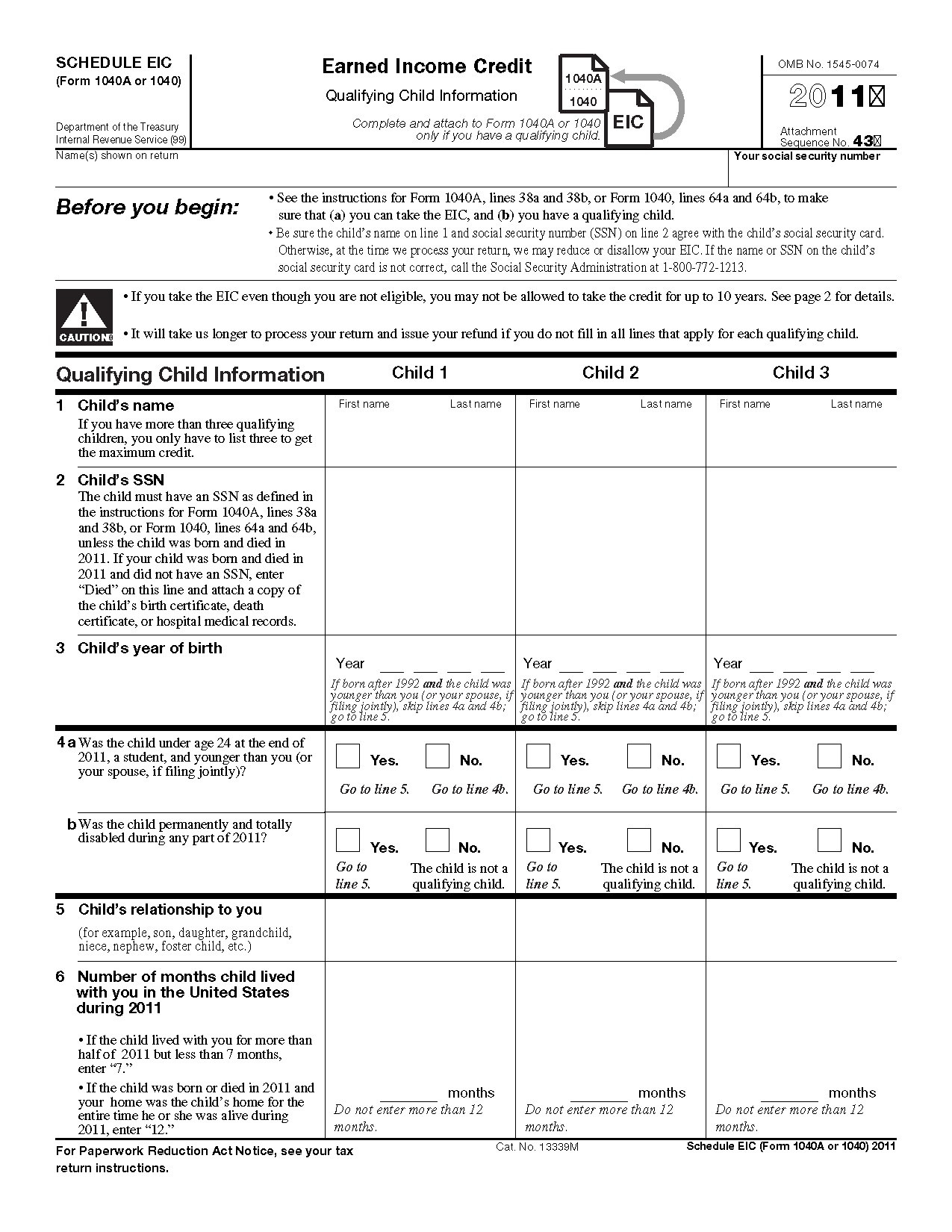

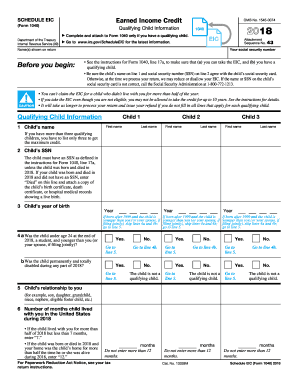

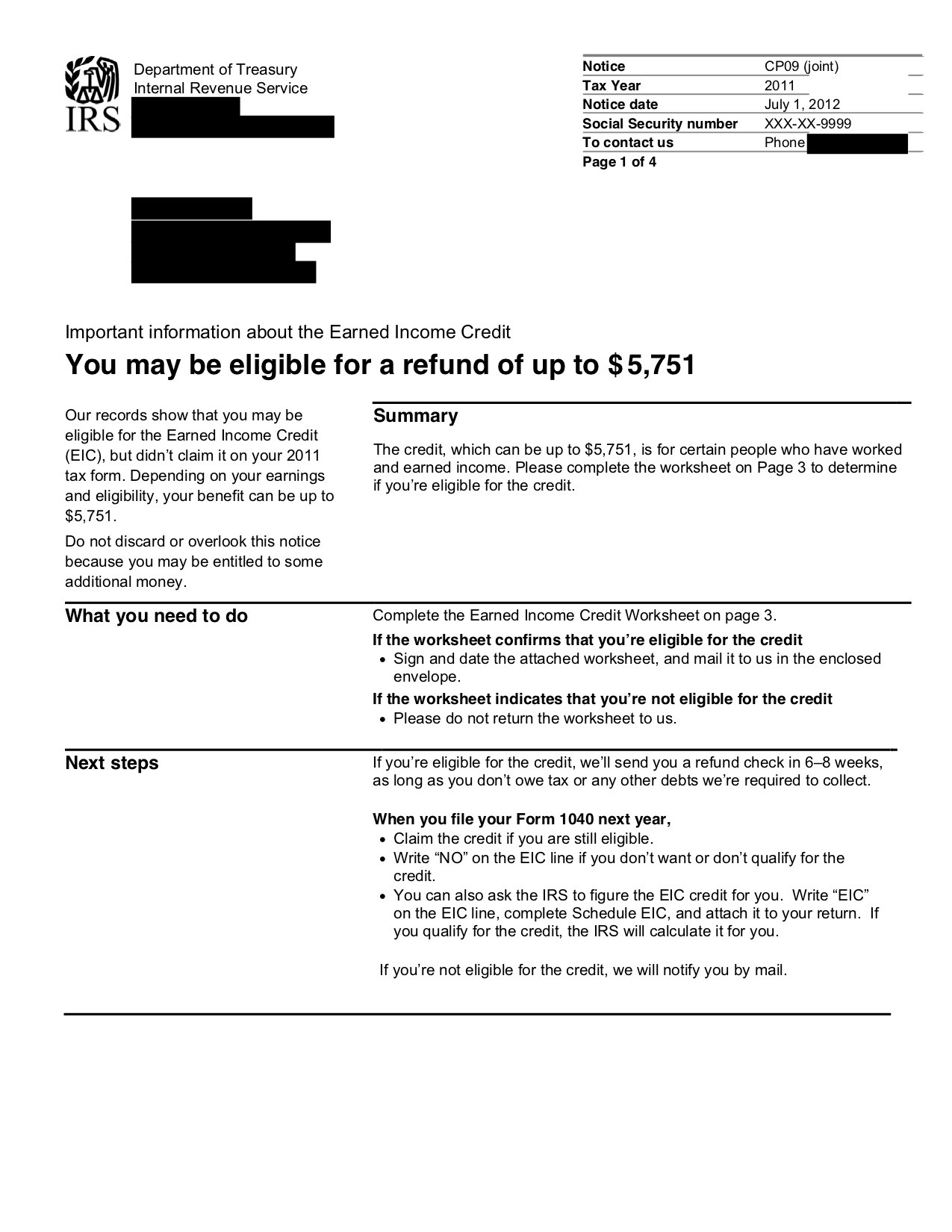

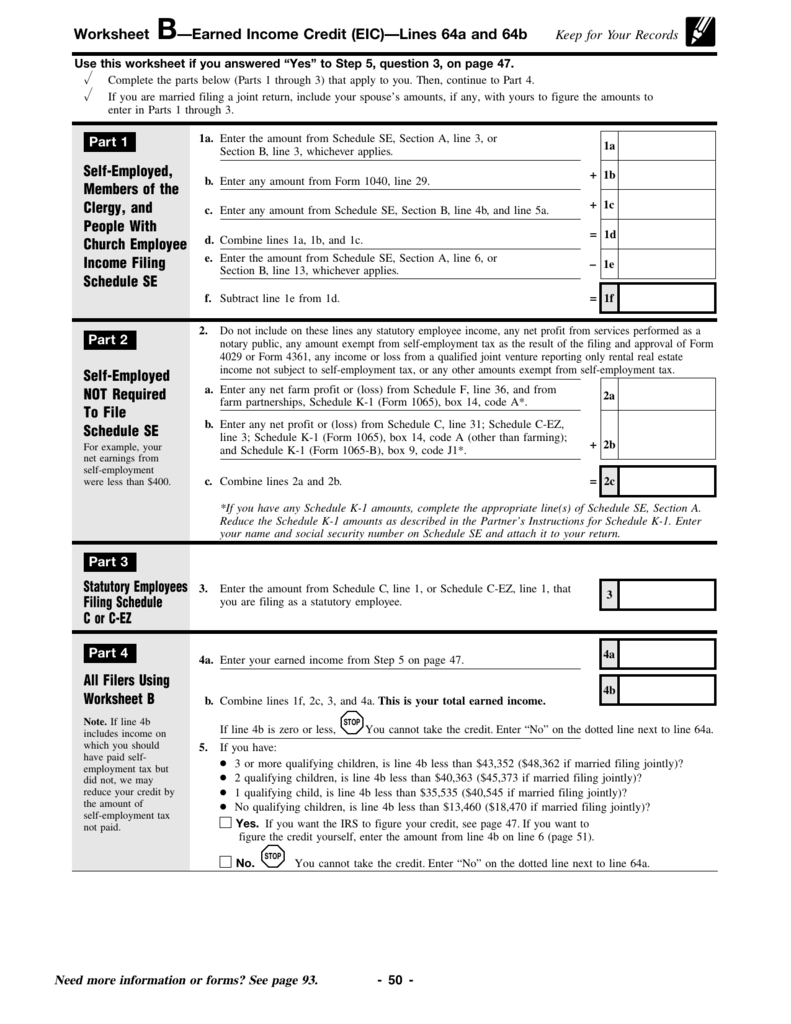

Worksheet B Earned Income Credit Eic. The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. In addition to the child qualification guidelines and income limits required to qualify a household for the EIC, a series of other eligibility requirements must be met.

The Earned Income Credit (EIC) is a refundable tax credit available to working individuals with low to moderate incomes.

EITC is the "big kahuna" of refundable tax credits!

The Earned Income Credit (EIC), aka Earned Income Tax Credit (EITC) is a valuable credit for low-income taxpayers who work, but it can be Earned income —You must have earned income to meet the qualifications for the earned income credit. In addition to the child qualification guidelines and income limits required to qualify a household for the EIC, a series of other eligibility requirements must be met. Instruction Tax And Earned Income Credit Tables.