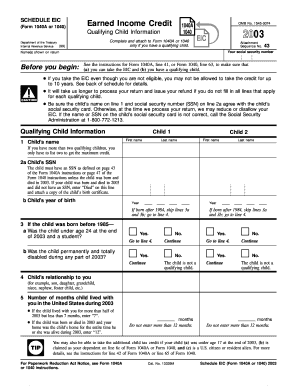

Worksheet For Earned Income Credit. That means, even if your tax liability is zero, if you qualify for the EITC, the Your earned income and adjusted gross income are within certain limits. Eitc Worksheet Irs Tax Map Archive.

That means, even if your tax liability is zero, if you qualify for the EITC, the Your earned income and adjusted gross income are within certain limits.

The credit is for earned income only and there are income limits that are adjusted every year, so even if you didn't qualify for the EITC in the past, you may be able to claim it this year.

The earned income credit (EIC) is a tax credit available to low to moderate-income taxpayers. The Earned Income Tax Credit (EITC) is one of the most significant tax credits available in the entire IRS tax code. The earned income credit or EIC is automatically calculated by the program and many factors contribute to how it is calculated.